Happy news for the home buyers, interest deduction in the home loans!

Recently there has been a steady rise in the number of homebuyers. The rising demand for the apartments is met with the ever-rising towers standing elegant. Also, as we check we can see there are many systems to support the buyers including the home loans. Recently, budget 2019 has brought about a big change in the housing sector, especially the affordable housing sector. The enhanced interest deduction in home loans can be considered as an absolute winning for the affordable housing sector. Read about the budget 2019 and its effect on affordable housing.

Home loan – a headache?

As we can see now, attaining a home loan wasn’t quite an easy procedure before. With the amendment of the laws as well as the efficient methodologies employed in, home loans are no more a headache now. But how about the interest rates?

In India, the interest rates start around 8% and then it goes high. Sometimes paying off, only the EMIs are too much for a homebuyer. All these factors again contribute to adding the difficulty level for getting a home loan. So getting the deduction in the interest rate will actually help the homebuyers a lot.

What were the problems faced?

Read about some major home loan problems. Also, homebuyers usually experience some problems with interest rates, deduction and many more. Read on.

- Rejection of the home loan applications at the very first go.

- Many times the processing fees are not refunded if in case the loan isn’t sanctioned.

- The total amount that is sanctioned become less than the actual amount submitted for approval.

- The disparities in the interest rates and deduction offered.

- The variation in property value during different time

- The extra burden of down payment

- Not having the documents in the right form

Housing for all by interest deduction

Providing housing for all by 2022 is the ultimate aim and interest deduction is just a part of it. The new budget made many new amendments, apart from the housing sector changes and the changes in the interest rates. As we have already discussed, there are many problems when it comes to availing a home loan. The changes this time is expected to bring a change in the way the real estate sector functions.

Till the new proposal

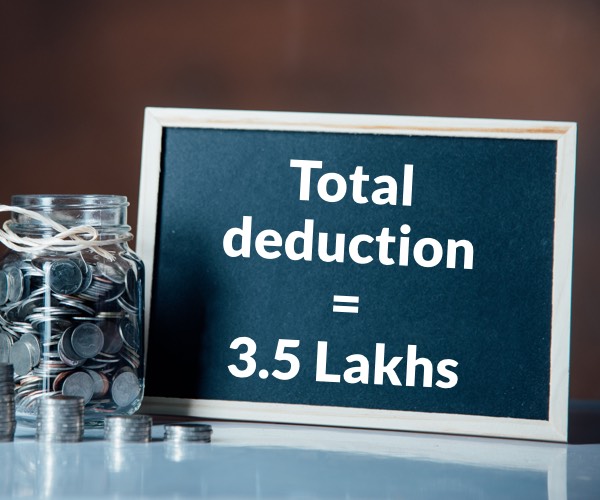

Previously, the limit on housing interest deduction was up to 2 lakhs. As part of the housing for all by 2022 concept, there was a limit up to which the interest of the home loan can be deducted. The earlier system of interest deduction rate was for people who had a self-occupied property and 2 lakh was the limit.

Union budget and the interest deduction

But according to the 2019 budget and the reforms in the housing sector, there has been an increase to this limit. The new proposal focuses on bringing an additional reduction of Rs 150,000 on the home loan interest rate. This sums up to a total of 3.5 Lakh deduction in the interest rates for home loans. That is to say, the amount to be deducted can now be more compared to the old times. This is supposed to help all the middle-class people who want to invest in a property, yet in need to take a home loan.

Conditions applicable

But, there are few conditions which are applicable to avail the home loans easily. Read about it here.

- The loans are available only for an affordable house valued up to 45 Lakhs

- The time frame for taking the loan is from 2019 July till March 2020

- This is effective only in this fiscal year

- There shouldn’t be any property in their name during the sanctioning of the loan

Benefits availed

- The interest deduction can now be claimed up to 3.5 Lakhs

- The saving is around 7 Lakh for middle-class men over the loan tenure of 15 years

The in-effect and interest deduction

So far we have been talking about the home loan, the recent proposals in the budget that supports the housing sector and even the interest deduction on home loans. All these changes are expected to bring a change in the way the real estate sector functions and will provide easy access to home loans, resulting in less interest, more savings and a home for all.

You can also read on how to choose a perfect bank for home loans here.